Private individuals are seeking greater flexibility in car financing in terms of monthly payments, financing periods, and services. At the end of their contract, they also appreciate having the choice of returning, buying or replacing their vehicle. RCI Bank and Services is responding to these changes in consumer behavior through the diversity of its offers. We take a closer look at a deep-seated trend.

For new vehicles, private individuals are turning increasingly to flexible financing such as balloon loans[1] , lease financing[2] , and long-term leasing[3]. The common point shared by these financing options is that they enable customers to acquire the vehicle that best corresponds to their expectations and budget over the years.

This present-day market development mirrors the trend observed 30 years ago with professional customers, which opted to externalize their fleets to lease companies. The UK and the USA were the first to propose flexible automotive financing to private individuals. In 2016, balloon loans, lease financing and long-term leasing accounted for one-third of RCI Bank and Services new vehicle contracts, up two points on 2015.

The biggest growth last year was reported in Spain and Ireland, with increases of 14 and 11 points respectively. And the trend is taking off outside Europe. At end-2016, RCI Financial Services Korea launched a balloon loan that has proved successful with first-time buyers and people aged under 30 in South Korea.

The boom in lease financing in France

Designed to adapt to the needs of motorists, lease financing is a vehicle leasing solution for a set period of between two and five years. Customers can add on services such as insurance, assistance, warranty extensions, and servicing. At the end of their contract, customers can either buy their vehicle at the price determined when signing the contract or return it.

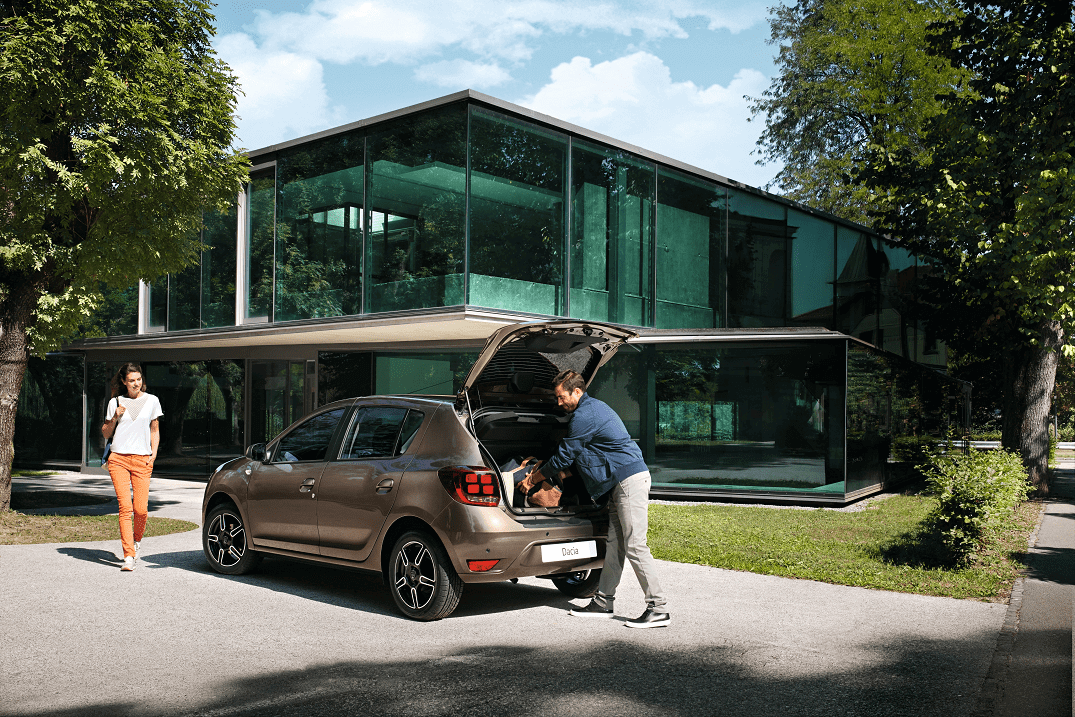

Combining flexibility and services, this offer is winning over more and more people each year in France. In France, lease financing now accounts for nearly 62% of new financing contracts for Nissan and 60% for Renault. Dacia is not left behind: lease financing represents about half of financing contracts in 2016 up 30 points on 2015. This success results from the launch of offers expressed in euros per day, which has appealed to a broad range of customers by bringing new Dacia cars within the realm of everyday consumer goods prices.